Amex business checking Review 2024 (Everything that you need to know about)

Amex business checking Review 2024 (Everything that you need to know about)

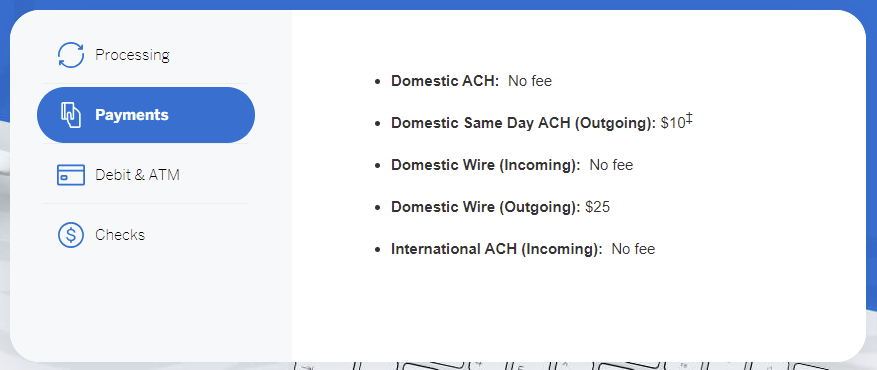

American Express has entered the advanced banking scene with the launch of its American Express Business Checking account in October 2021. This free commerce checking account could be a game-changer, offering a range of highlights that set it apart from other online accounts. With no month to month fees or charges for services like stop-payment requests and wire transfers, business proprietors can focus on growing their company without worrying about additional costs.

But what truly sets American Express Business Checking separated is its extraordinary customer service, offering 24/7 live support, a competitive interest rate, and a generous welcome reward. Deposits can be made through portable check deposit, ACH, and wire transfers, and account holders can withdraw cash from over 70,000 MoneyPass and Allpoint ATMs over the US without incurring fees. In any case, please note that you can’t deposit cash and may face fees from out-of-network ATMs.

AmEx Business Checking account is ideal for little business owners who value gaining interest on their account balance, do not bargain with cash transactions, appreciate a highly appraised app and 24/7 customer support, and want to earn AmEx Membership Rewards points. With American Express Business Checking, you can streamline your monetary operations and focus on what things most – developing your trade.

American Express business banking

Amex business checking offers a comprehensive extend of features and benefits for little business proprietors. Here are the key subtle elements:

Fees:

No month to month maintenance fees, giving you peace of mind and adaptability to oversee your finances.

Minimum Opening Deposit:

You’ll be able to open an AmEx business checking account with no minimum deposit necessity, making it simple to get started.

Interest Rate:

Gain a competitive interest rate of 1.30% APY (Annual Percentage Yield) on equalizations up to $500,000. This means you’ll be able to win interest on your business funds whereas still having access to your cash once you require it.

Transactions:

Appreciate unlimited transactions, counting deposits, withdrawals, and transfers, without any limitations or fees.

Cash Deposits:

Tragically, cash deposits are not supported through the amex business checking account. However, you’ll be able to deposit funds through mobile check deposit, ACH (Automated Clearing House) transfers, and wire transfers.

Bonus:

New customers can earn a generous welcome bonus of 30,000 Membership Rewards points. You can recover these points directly into your amex business checking account or exchange them for other rewards and benefits through the Membership Rewards program. Terms and conditions apply.

ALSO READ: BEST CAPITAL ONE BUSINESS CREDIT CARDS

American Express AmEx Business Checking account opening

Opening an AmEx business checking Account: What You Need to Know

Application Process:

1. Online Application: You can apply for an American Express business checking account online or through the mobile app in just a few minutes.

2. Basic Information: You’ll need to provide some basic information about your business, including:

- Industry

- Revenue

- Business email

- Your personal information, including: Name, Address & Date of birth

3. Funding Your Account: Once approved, you have 60 days to fund your account using one of the following methods:

- ACH (Automated Clearing House) transfer

- Wire transfer

Required Documents:

To open an AmEx business checking account, you’ll need to provide the following documents:

1. Business Information

- Business name

- Legal structure (e.g., sole proprietorship, LLC, corporation)

- Industry

2. Revenue Information:

- Annual revenue

3. Identification Documents:

- Employer Identification Number (EIN)

4. Personal Information:

- Your name

- Address

- Date of birth

5. Beneficial Owner Information:

If you’re applying as a business with multiple owners, you’ll need to provide the following information for each beneficial owner (those with more than 25% stake in the business):

- Social Security number

- U.S. Government-issued photo identification

Additional Documents:

Depending on your business entity type, you may need to upload additional documents with your application, such as:

- Articles of Incorporation

- Certificate of Formation

- DBA (Doing Business As) Certificate

Please note that the specific documents required may vary depending on your business entity type and other factors.

Minimum funding requirement must be met within 60 days of American Express Business Checking account opening

Welcome Offer for New American Express Business Checking Customers

Earn 30,000 Membership Rewards Points:

As a new AmEx business checking customer, you can earn a generous welcome offer of 30,000 Membership Rewards points. These points can be converted into deposits directly into your AmEx business checking account, or redeemed for other rewards such as travel, gift cards, or cash back.

Eligibility and Requirements:

To earn the welcome bonus, you must meet the following requirements:

1. Deposit Requirement: Deposit a total of $5,000 or more within 30 days of account opening. Eligible deposits include:

* All types of deposits except those made using the Redeem for Deposits feature

* Deposits from interest payments

* Deposits from other American Express Business Checking accounts

2. Average Balance Requirement: Maintain an average balance of $5,000 or more for the next 60 days after meeting the deposit requirement.

3. Transaction Requirement: Complete at least five transactions within 60 days of account opening. Qualifying transactions include:

* Mobile deposits

* Check deposits by mail

* Electronic transactions such as:

+ ACH transfers

+ Wire transfers

+ Bill payments

Note that the following transactions do not qualify:

* Business debit card transactions

* Deposits made using the Redeem for Deposits feature

Redeeming Your Points:

Once you’ve earned your welcome bonus, you can redeem your Membership Rewards points for a variety of rewards, including:

* Deposits directly into your American Express Business Checking account

* Travel bookings

* Gift cards * Cash back

Please review the terms and conditions for full details on the welcome offer and redemption options.

Limitations of American Express Business Checking

Money Conundrum

Whereas American Express Business Checking offers a helpful online banking experience, there’s a critical limitation to consider:

No cash deposits allowed. That’s right, you can’t essentially walk into a department or utilize a deposit slip to include cash to your account. Instead, you’ll got to rely on ACH transfers, wire transfers, or mobile check deposits (available on iPhones only).

Cash-Heavy Businesses Be careful

In case your business depends heavily on cash transactions, you might need to see elsewhere. American Express Business Checking doesn’t offer the adaptability to deposit cash, which may lead to delays or extra fees. Consider alternative business bank accounts that offer simple cash deposits with no caps or expenses, such as Lending Club Custom-made Checking or the NBKC trade account.

ATM Access

Restricted and Limitedly Free

Whereas amex business checking account does offer ATM get to through the Allpoint and MoneyPass systems within the US, you’ll still confront expenses for withdrawals exterior of these systems. And do not anticipate to be able to deposit cash at an ATM – that’s not an choice at this time.

Additional Fees and Limits

When utilizing ATMs exterior of the Allpoint and MoneyPass systems, be arranged for expenses from the ATM owner and/or network. Furthermore, ATM withdrawal limits apply, and American Express applies foreign exchange fees to withdrawals in foreign currencies.

Find Your Nearest ATM

Before you sign up for American Express Business Checking, make sure you know where your closest participating ATM is. Visit americanexpress.com/atm-locator to find ATMs within the US.

Keep in mind, all information about American Express Business Checking has been collected freely and has not been checked on or given by the guarantor or supplier of this item or benefit.

FAQs

1. Is American Express good for a business account?

2. Is it hard to get approved for American Express as a business?

3. Are AmEx business cards hard to get?

4. Is AmEx business Platinum easy to get?

5. What credit score is needed for American Express business?

6. Does Amex business have a limit?

7. Why do most business not accept American Express?

8. What is the minimum income for Amex business Gold?

9. Does applying for an Amex business card hurt your credit?

10. What is the most difficult Amex card to get?

11. Is it prestigious to have an Amex card?

12. Can you have 2 Amex business cards?

13. Are people with Amex Platinum rich?

14. Is there a minimum salary for Amex Platinum?

15. What fico for Amex Platinum?

16. What’s the easiest Amex card to get?

17. Who does Amex pull for business credit card?

Author: